Back the Gun Tax

As of Nov. 13, there have been 602 mass shootings in the U.S. this year alone. This statistic has been steadily climbing with every sale of ammunition and guns that are utilized to inflict harm rather than acting in self-defense. Therefore, it is only fair that the taxes from such transactions are put toward increasing school security presence. Gov. Gavin Newsom more than doubled the tax rates on guns and ammunition, with a promise of the funds serving to improve safety standards (Cable News Network). Out of the estimated $159 million that this new tax will bring to California’s budget, $75 million of it will go to California Violence Intervention and Prevention Grant Program and $50 million will go to the State Department of Education (NPR). With over 35,000 deaths related to gun violence in this year alone, this is a small price to pay (Gun Violence Archive).

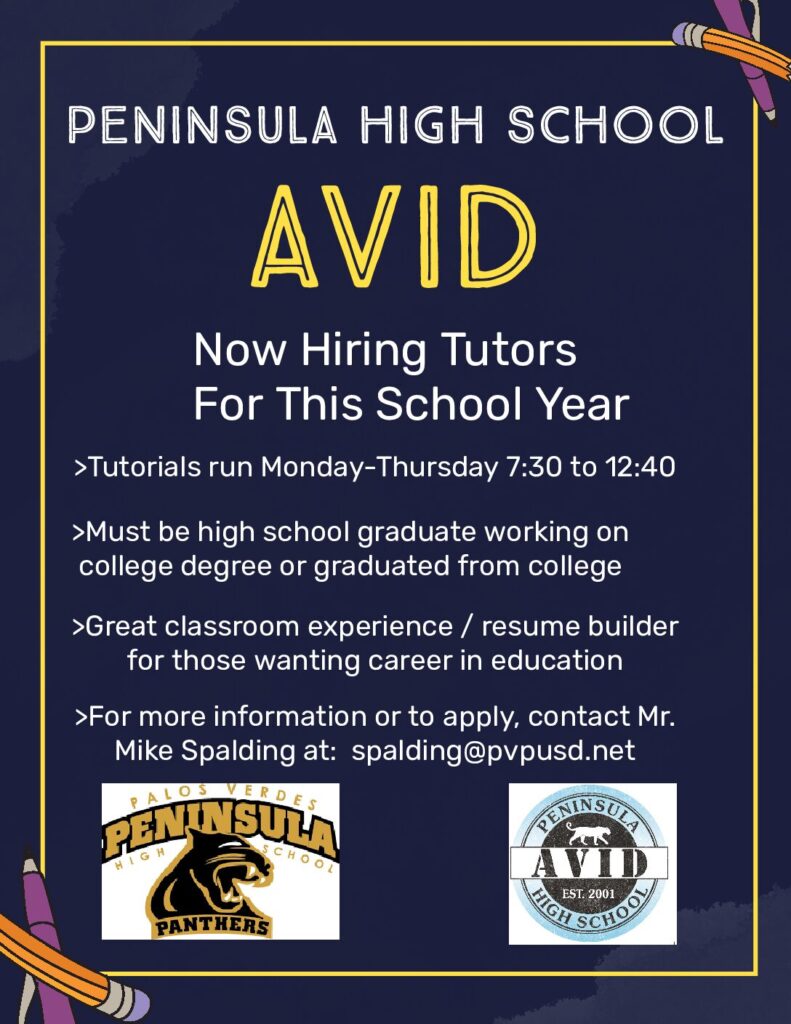

Peninsula is a fairly unique school in regard to security precautions. The school is lucky enough to have a retired Lomita Sheriff, David Rozas, as the school resource officer (SRO) who is in charge of safety and crime prevention on campus. It is an absolute necessity to have someone dedicated to these tasks on campus for the safety of students, teachers and staff. Safety precautions should not be limited or reduced depending on grade levels; everyone deserves to feel safe while learning. However, the U.S. Department of Education reports that high schools are more likely to have SROs than middle schools or elementary schools. This is a concerning report seeing as two out of the three school shootings with the highest death tolls to date were at Sandy Hook Elementary School and Robb Elementary School. Safety drills to combat a shooting have remained unchanged leaving serious exposure to shooters that have sat through the same drill with knowledge of the school procedures. The hope is that this tax will allow more schools of all education levels across states to adopt practices similar to those within California.

Despite the need for safer precautions and protocols that would be improved through the tax, it is no secret that many believe the additional charges to be unconstitutional and vindictive. Keep in mind, this tax is not taking away the right from anyone to buy a gun, but simply raising the price making access more limited than before. Yet, people against the tax argue that everyone should be able to protect their families with one of their fundamental entitlements: the right to bear arms. However, when the statistics are examined, it becomes clear that people who live in homes with gun owners are more than twice as likely to die by homicide (Stanford Medicine). Following the logic set forth by these statistics, buying a gun would more likely endanger a person’s family, not protect it.

Of course, this rapidly progresses into heated discussions of whether guns kill people or people kill people. If examined from a larger perspective, those people may realize that in reality, a person could inflict harm with anything. A person could be stabbed, ran over or pushed off a roof. If a person possesses the intention to harm another, they will find a way. However, the indiscriminate distribution of guns makes it much easier. Although an important factor is the person in possession of the gun and their mindset, it is important to acknowledge that having guns widely accessible enables the senseless killings of innocent lives. While California has never been a particularly pro-gun state due to its largely Democrat and Liberal population, it is encouraging to see at least one state is setting an example for this year’s school shooting hotspots in the midwest. It is of utmost importance that the rest of the nation follows in California’s footsteps with higher gun taxes and greater emphasis on campus security to prevent further casualties.